- March 28, 2022

- Vasudev Innovative Software

- 0

NFT! You might have heard this word before in your life. It is one of the trending hot topics of the crypto world. Many celebrities are making millions by selling strange stuff as NFT such as the CEO of Twitter ‘Jack Dorsey‘ who sold his very first tweet as NFT for $2.9 Million and Elon Musk was selling a song about NFT, itself as an NFT. Click here to have a look. So, what exactly is an NFT, and why everyone is driving crazy about it? Let’s understand this in detail.

What is NFT?

NFT is also known as ‘Non-fungible Tokens’ in its expanded form where non-fungible means non-replaceable. A thing that is one of its kind. For an instance, the portrait painting of the Mona Lisa is a unique creation by Italian artist Leonardo Da Vinci. No matter, how great a painter you are to depict that painting, you will never be able to match the level of the original painting of the Mona Lisa because it is one of a kind and you cannot replace it. Besides, everyone is familiar with tokens. It can be simply a piece of paper, metal, or anything that can be used as an alternative to money (however not everybody has it like money). In a layman’s language, we can buy anything sellable, but it does not do the same with the token. With tokens, one can buy only the things for which tokens are made.

How Do NFTs Work?

Since now you are aware of the terms Non-fungible and Tokens; let’s discover how NFT works? To buy and sell one-of-a-kind digital pieces around the world, NFT was developed. It is also known as a digital asset or virtual art.

Consider the following for an instance to better understand how NFT works. Suppose, you have digital art and you create NFT of that. You’ll be assigned a digital token to certify that you are the owner of that particular asset (say digital art). Now you may sell this NFT whenever you want. All this buying and selling process is done through Ethereum Blockchain Technology. Just like Bitcoin, Ethereum is also a famous cryptocurrency & NFT can be bought or sold by only using Ethereum. However, Binance (crypto exchange platform) allows you to buy or sell NFT with their cryptocurrencies BNB and BUSD.

Ethereum was the first cryptocurrency to introduce smart contracts. A smart contract is a tiny piece of code that lives on the blockchain, and it’s the technology behind the decentralized finance (DeFi) industry. A large proportion of decentralized applications are built on the Ethereum ecosystem, although Ethereum now has a lot of competitors that want to take some of its market shares. You must be thinking, is there any type of NFT? Well, there is no such type of NFT. One can create and sell unique things that can be presented digitally, such as art, games, music, film, or any video.

How to Trade NFT?

Certain platforms are developed particularly to buy or sell NFTs. Rarible, Binance, and open-Sea are some of the popular ones and are considered safe. However, the process of buying and selling NFTs differs from a simple buy and sell. One must have a digital wallet to buy/sell NFTs. This wallet can be accessed from Metamask (a free internet browser extension). For a better understanding, let’s say you are buying an NFT of a painting. You’ll not get the original piece of painting, however, you will receive an NFT certificate instead that would be linked to blockchain technology to ensure that you are now the owner of the painting’s NFT.

Can you purchase NFT with INR, USD, EURO Currencies?

No! one cannot buy NFT with such currencies. You need to have the same value of Ethereum in your wallet (equal to its price) to buy the NFT. Therefore, the only currency suitable for buying and selling NFTs is cryptocurrency – Ethereum. However, you can definitely buy virtual currency with credit and debit cards, UPI, bank transfers, etc.

How to Buy Ethereum?

If you are buying Ethereum for the first time, it can be a little challenging. You’ll have to perform a lot of research to find the right platform for you in order to buy one. One must determine the level of risk before investing in Ethereum. Cryptocurrencies are vulnerable to price fluctuations. Although it had amazing returns in the past, it also faced some notable crashes (from $4000 per coin to $1800 in a month). Therefore, it is of utmost importance to consider your risk tolerance along with the stability of the rest of your investment portfolio. As recommended by the experts – Never Invest in Crypto More than you can Afford to Lose.

1) Choose a Crypto Exchange Platform

Cryptocurrencies are not traded on major exchanges and many brokerages do not offer crypto investing. Buying ether is a little more complicated in comparison to buying mutual funds through your current brokerage account. All you need is to create an account on the crypto exchange platform. These platforms allow buyers and sellers to exchange fiat currencies like dollars with cryptocurrencies like Ethereum, Bitcoin, and Dogecoin. Do some research on the best cryptocurrency exchanges and find the right one for you. However, take care of a couple of things while choosing a crypto exchange platform:

- Make sure the exchange you choose has a crypto wallet to store your investments.

- If it won’t offer, you have to get one of your own.

Platforms like Robinhood and Cash App are good to go for beginners as they’ll simplify the crypto purchasing process for you. But, they have a hidden cost – One cannot withdraw his/her Ethereum investment to put it in a third-party wallet or use it to pay for online purchases. Your crypto will only be traded within the platform you buy it on. So, if you want to hold it in a separate wallet, you need to cash it out from that platform and rebuy it on a crypto exchange.

2) Fund Your Account

One needs to fund his/her account before buying Ethereum through a crypto exchange. Mostly, money is deposited from a bank account (personal or savings). One may also use a debit card or deposit money from PayPal. The crypto exchange fees may vary according to the funding method you choose. Gemini (crypto exchange platform) offers free wire transfers, however, it charges a 3.49% fee on debit card transfers.

Note: Some crypto exchange platforms allow you to buy cryptocurrency using a credit card. However, you might have to pay high interest and cash advance fees on top of crypto exchange fees depending on the credit card you have.

3) Purchase Ethereum

Unlike stocks and mutual funds, Ethereum purchasing is not limited by market hours. These decentralized currencies can be bought and sold around the clock. The ticker symbol for Ethereum is ETH. In order to purchase it, one needs to enter its ticker symbol ETH in your crypto exchange’s “BUY” field and input the amount you want to buy. If you are not willing to buy a complete Ethereum token, you can purchase a fraction of it. For an instance, the price of Ethereum is $2000 & you can invest only $100, you’ll receive 5% of an Ether Coin. This is similar to purchasing a fractional share of stock.

Where to Store Your Ethereum?

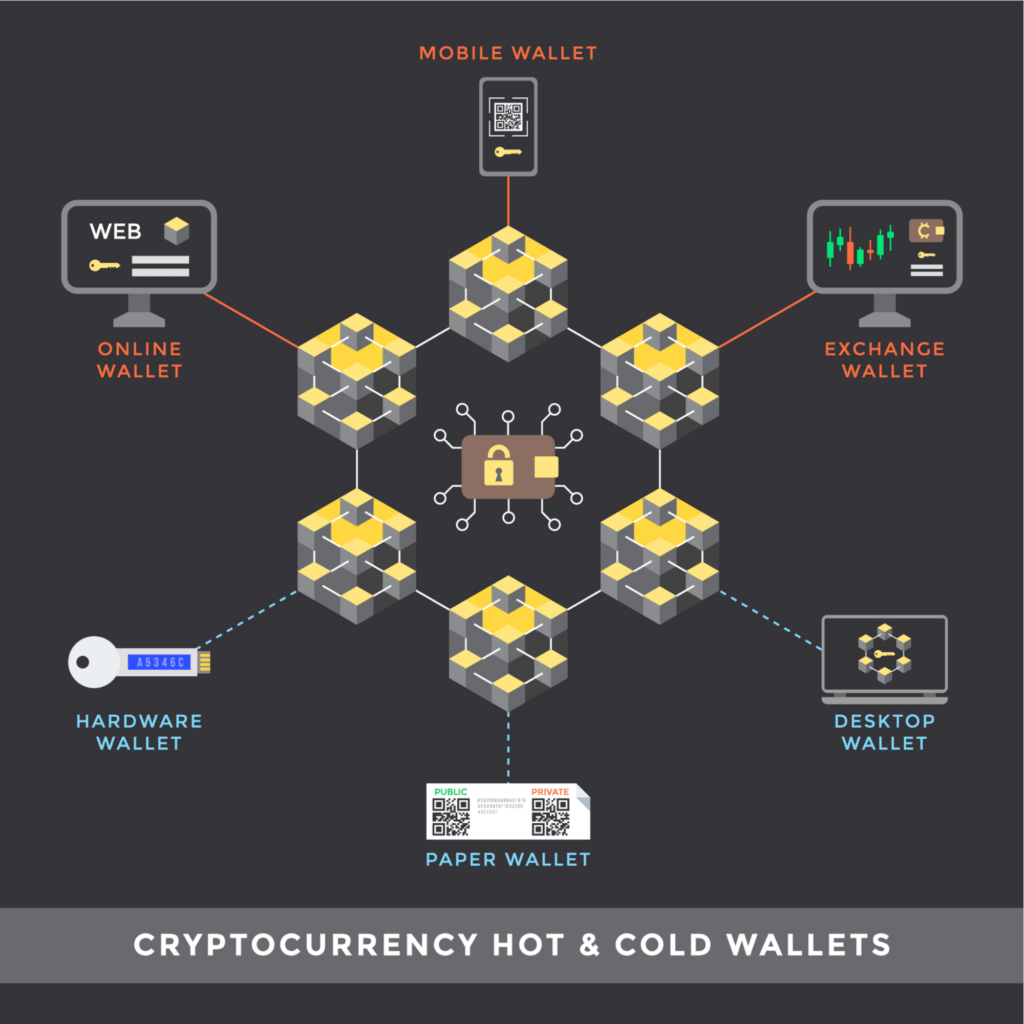

One also has to store his/her cryptocurrency after purchasing it. Some platforms store it for you while many people store their investments themselves to reduce the risk of losing their cryptocurrency. You may also choose to move your cryptocurrency to third-party wallets. There are two types of third-party wallets: Hot Wallet & Cold Wallet.

1) Hot Wallet

A hot wallet or a software wallet is a form of digital storage that is connected to the internet and can be accessed on a computer or a phone. In comparison to cold wallets, hot wallets are less secured due to the internet connection. Many crypto exchange companies offer a separate hot wallet at no additional cost to let you keep your crypto with them. However, hot wallets are at a high risk of security breaches.

2) Cold Wallet

A cold wallet or a hardware wallet is a physical device that keeps your cryptocurrency offline. Most of them look like USB drives. This may prevent you from hacking and other security breaches, however, there is no backup to this form of storage. In case, you misplace your wallet, you’ll lose access to all your investments. To stay safe, make sure you buy your hardware wallet directly from the manufacturer.

How to Make an NFT?

1) Select Your Item

Starting with the basics, you’ll need to determine – What unique digital asset you want to turn into an NFT? It could be a picture, music, video game, meme, gif, or even a tweet. A non-fungible token or NFT is a unique digital item with a sole owner. Make sure that the item you are turning into an NFT is your intellectual property, otherwise, it can get you into legal trouble.

2) Choose Your Blockchain

After selecting your unique digital asset, start the process of minting it into an NFT. And, that begins by confining the blockchain technology, you intend to use for NFT. The most popular NFT creators are Beeple and Pak. Top NFTs sold so far are:

a) Pak’s The Merge: $91.8 Million – Most expensive NFT sold on 2nd December 2021.

b) Everyday: The First 5000 Days: $69.3 Million – Second masterpiece NFT sold by Beeple. Beeple’s crossroad NFT was also on-trend before.

c) Beeple’s Human One: $29 Million – Sold on 9th November 2021 at a whopping amount of 29 Million USD.

3) Set Up Your Digital Wallet

If you don’t have a digital wallet, set one. Since you’ll need some cryptocurrency to fund your initial investment; the wallet will provide access to your digital assets. Some of the most popular NFT wallets are Metamask, Math Wallet, AlphaWallet, Trust Wallet, and Coinbase Wallet. (Click here and learn to create Metamask Wallet). After setting up the wallet, buy some cryptocurrency. In case, you already own some cryptocurrency, connect it to your digital wallet in order to use it for creating and selling NFTs.

4) Select your NFT Marketplace

To create and sell NFT, one needs to choose an NFT marketplace. Some of the most popular NFT Marketplace are OpenSea, Axie Marketplace, Larva Labs/CryptoPunks, NBA Top Shot Marketplace, Rarible, SuperRare, Foundation, Nifty Gateway, Mintable, and ThetaDrop. Do some research on each NFT marketplace and find a platform that is a good fit for your NFT. Some marketplaces require their cryptocurrency – such as Rarible requires Rarible (CRYPTO: RARI)

OpenSea being a leader in NFT sales is a good place to start if you are looking to create and sell one. Once you have chosen your NFT marketplace, connect it to your digital wallet. It allows you to pay the necessary fees to mint your NFT.

5) Upload Your File

You can now mint your NFT. Wondering what is meant by Minting? It is a process that involves signing a blockchain transaction that outlines the fundamental token details. It is then broadcasted to blockchain for triggering a smart contract function that creates the token & assigns it to its owner.

An NFT or non-fungible token consists of a unique token ID which is then mapped to an owner ID stored inside a smart contract. A smart contract is a primary code by which developers can create and manage tokens on a blockchain. Smart contract stores small amounts of data in common data structures that are a vital component of tokenization. It helps in identifying/tracking the owner of the token. When the owner of a given token ID wishes to transfer it to another user, it is easy to verify ownership and reassign the token to a new owner.

The NFT marketplace you have chosen would have a step-by-step guide for uploading the digital file into the platform. It will enable you to turn your digital file (a PNG, GIF, MP3, or another file type) into a marketable NFT.

6) Setting Up Sales Process

This is the last and final stage in the NFT minting process. This is where you decide how you want your NFT to be monetized. You can sell your NFTs as per the following norms depending upon your marketplace platform.

- Sell at Fixed Price

You can set a fixed price that will allow the first person to meet the price of NFT and buy it.

- Sell at Timed Auction

Setting your NFT at a timed auction will give the interested ones a specific time limit to submit their final bid to buy your NFT.

- Sell at Unlimited Auction

Setting an unlimited auction will not set a time limit. Besides, you’ll need to control the eagerness of ending the auction whenever you want.

Note: Determine the minimum price if you are setting up an auction to sell your NFT. Do not forget to keep fees in mind while setting up the minimum price as you can lose money on your NFT sale in case you set the price too low. Fees can fluctuate due to the volatility in the price of the cryptocurrency. Therefore, the expense to mint and sell an NFT can be costly and confusing. It is crucial to have a close look at the costs you have to pay to make and sell your NFT to ensure that it is worthwhile.

Should You Buy Non-Fungible Tokens (NFTs)?

Since the future of Non-Fungible Tokens or NFTs is uncertain, therefore it is risky to buy one as we do not have a lot of history to judge their performance. They are so new, may be worth investing in small amounts to try it out. To summarize, investing in NFTs is a largely personal decision. Besides, it may be worth considering if you have money to spare and NFT holds meaning for you. However, remember, an NFT’s value is based entirely on what someone else is willing to pay for it. There may be a chance that an NFT would resale for less price in comparison to what you paid. All in all, do the research, understand the risks – including what you might lose after investing dollars & decide to take the plunge. So, proceed with a healthy dose of caution!

Hope this blog may have given you some clarity on what NFT is and why is it such a hot topic right now. Let me know in the comments section if I missed out on something. See you with another interesting topic next time 🙂

WRITTEN BY

Vasudev Arora

CEO & Founder

Providing the most agile and precise digital solutions at Vasudev Innovative Software. Noticing the evolution and growth in each member of VIS, I believe in expanding their knowledge and refining their quest for excellence.